About (CDB)

- Home

- About (CDB)

ABOUT US

Center Digital Bank CBDC CDB

The CBDC CDB is a digital currency CDB issued by a country’s central bank. The CBDC CDB, referred to as Digital Kip (DKIP), is comparable to the fiat money issued by the Central Digital Bank Currency CDB, which can serve as a medium of exchange, store of value, and unit of account, but in a “digital” form. It is similar to cryptocurrencies, except that the central bank fixes its value and it is equivalent to the country’s fiat currency. A nation’s monetary authority or central bank issues a CBDC CDB, which promotes financial inclusion and simplifies the implementation of monetary and fiscal policies

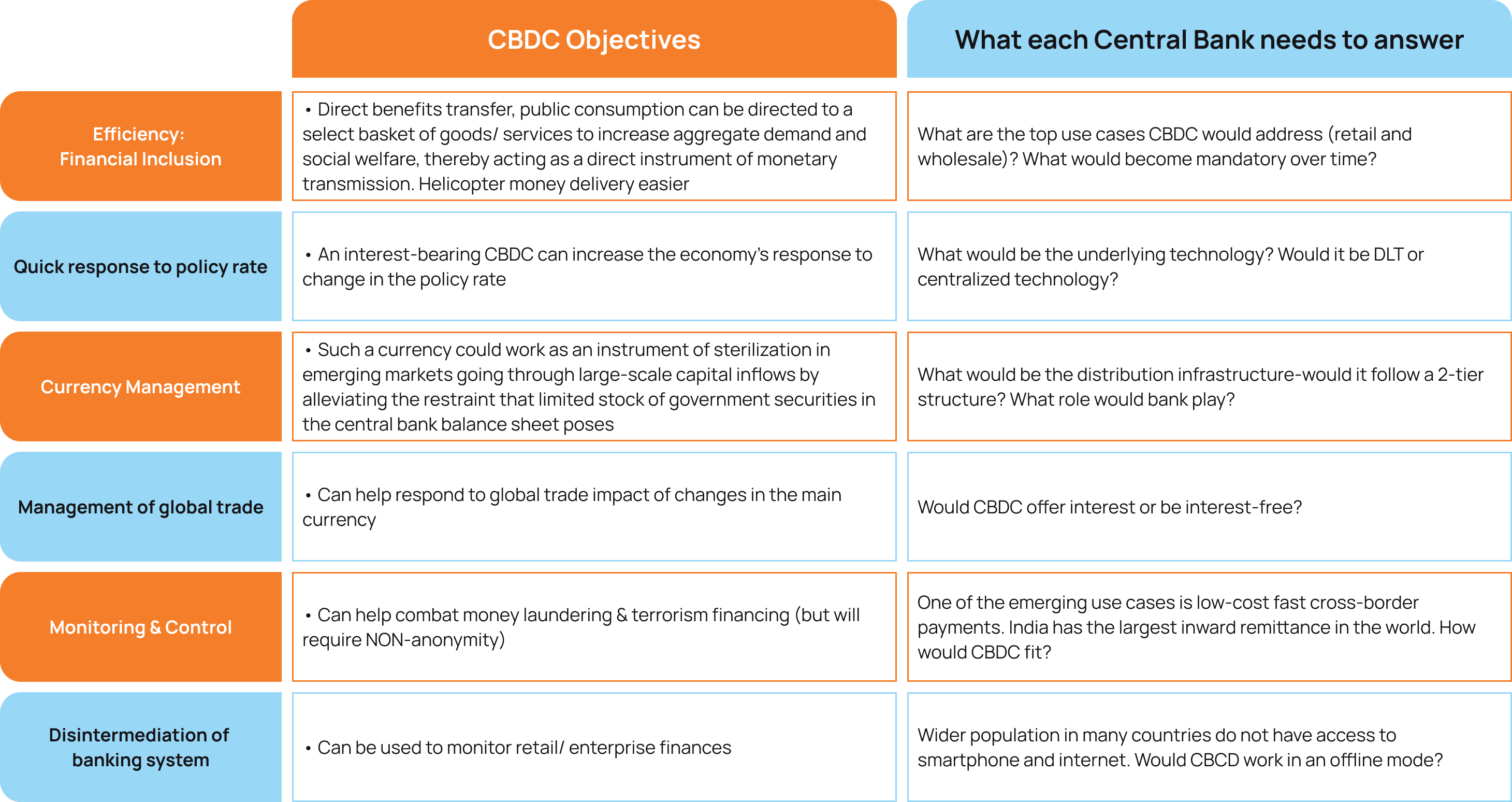

The main purposes of CBDCs are:

• To provide businesses and consumers conducting financial transactions with privacy, transferability, convenience,

accessibility, and financial security.

• Decrease the cost of maintenance that a complex financial system requires, reduce cross-border transaction costs,

and provide those who currently use alternative money-transfer methods with lower-cost options.

• Reduce the risks of using digital currencies, or cryptocurrencies, in their current form. Cryptocurrencies are highly volatile, with their value constantly fluctuating. This volatility could cause severe financial stress in many households and affect the overall stability of an economy. CBDCs, backed by a government and controlled by a central bank,

would give households, consumers, and businesses a secure means of exchanging digital currency.

Collaboration:

The Lao Government has been approached by the State Digital Bank Group (SDBG) to enhance the implementation of a Central Bank Digital Currency through the provision of cutting-edge technology. Additionally, SDBG has proposed to leverage its financial resources to fully support the launch of the Digital Kip (DKIP), utilizing blockchain technology and comprehensive system management to ensure a successful rollout. SDBG, under official registration with Tax No. 345856819-000 has received approval to implement the Central Bank Digital Currency CDB for the Lao People’s Democratic Republic, encompassing the following provision

1.Financial Commitment:

SDBG shall allocate the operating and sufficient supporting funds essential for the successful execution of this

project. It is imperative that 100% of these funds are verified as clean, cleared, and devoid of any associations with criminal activities.

2.Technical and Project Management Support:

a) SDBG will furnish the requisite blockchain technology to facilitate the implementation of the CBDC CDB.

b) SDBG will oversee and manage the project through its professional IT team, ensuring adherence to industry

standards and best practices.

Regulatory and Legal Compliance:

The Legal Entity Identifier (LEI), with reference Banking License No. 4205/ERM, has been duly obtained to ensure legal compliance that is recognized globally for the operation of the CBDC CDB. This measure underscores SDBG’s commitment to maintaining rigorous regulatory standards throughout the project’s lifecycle.

Central Digital Banking Platform : CBDC Modules

Central Bank Digital Currency: Objective and Approach

Central Digital Banking Platform :

CBDC Modules

Central Bank Digital Currency: High Level Approach

Accessibility, Transparency, Security, Privacy

1. Two Modes: Register based (Online) and Value Based (Offline)

2. Register based mode needs national backbone which is systemically critical

3. Flexibility to introduce attributes in future to facilitate

• Enforcement of rules to spend money for the intended purpose eg. School education, Hospitalization

• Trace money laundering, terrorist funding

• Auto retrieval of unutilized money after a time cap

• Knowing velocity of money in the economy

4. Security mechanism beyond SHA256 eg. Hardware device driven key which gets destroyed after the generation digital money

5. Provision for the government and corporate tag the intended use/benefit attribute

Conclusion

State Digital Bank Group has embarked on a significant initiative to install and implement the Central Bank Digital Currency CBD for The Lao People’s Democratic Republic, specifically the launch of Digital KIP currency. This strategic endeavor is designed to bolster the financial stability, flexibility, safety, and adoption of advanced financial systems within the country. Moreover, the introduction of digital cash or Digital KIP (DKIP) is anticipated to enable more payment service providers globally to connect directly with the Bank of Lao PDR’s settlement systems. The commitment reflects SDBG’s dedication to pioneering digital financial solutions that align with contemporary technological advancements while ensuring robust governance and compliance frameworks.

Center Digital Bank CBDC CDB

146 Unit 12 Khamphengmeuang Road,

Ban Nonghai, Hadxayfong District,

Vientiane Capital Lao PDR.

Telex: 51210611 CBDCLA G,

Tel: +856 (021) 225959

Fax: +856 (021) 457979

Central Bank Digital Currency-DDM

CID No.:DE79ZZZ00002744326 BBk

Sofioter St. 23, 99091 Erfurt Germany

Telex: 51210611 CBDCLA G